ኮምፕሪሆንሲቭ ስፔሻላይዝድ ሆስፒታል ዩኒቨርሲቲ ኣኽሱም ምስ HCP Cureblindness ብምትሕብባር ን 1000 ወገናት ነፃ ሕክምና መጥባሕቲ ስብሒ ዓይኒ ክህብ እዩ።

ኣብ ክልል ትግራይ ብዓይነታ ናይ መጀመርያ ዝኾነት 64 slices CT scan ሎሚ ዕለት Aksum University CHS & Comprehensive Specialized Hospital...

ኮምፕሪሆንሲቭ ስፔሻላይዝድ ሆስፒታል ዩኒቨርሲቲ ኣኽሱም ምስ HCP Cureblindness ብምትሕብባር ን...

AKU in collaboration with German Archeological Institute holds international workshop...

Every undergraduate student is eligible to receive a fellowship of up to $10,000 for a summer internship or faculty-mentored research project. Find your opportunity, make your case for how it fits your academic plans, and we will help fund it.

Professors from Friedrich Alexander University (FAU), Germany, and International Center for Research in Agroforestry have paid a visit at AKU....

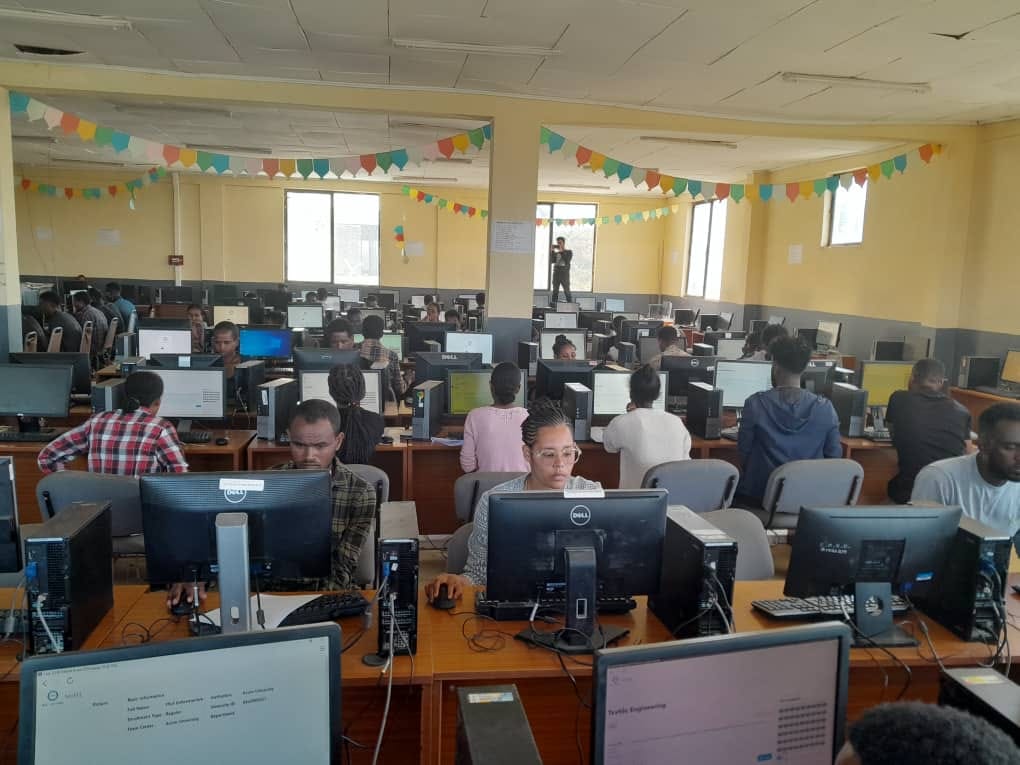

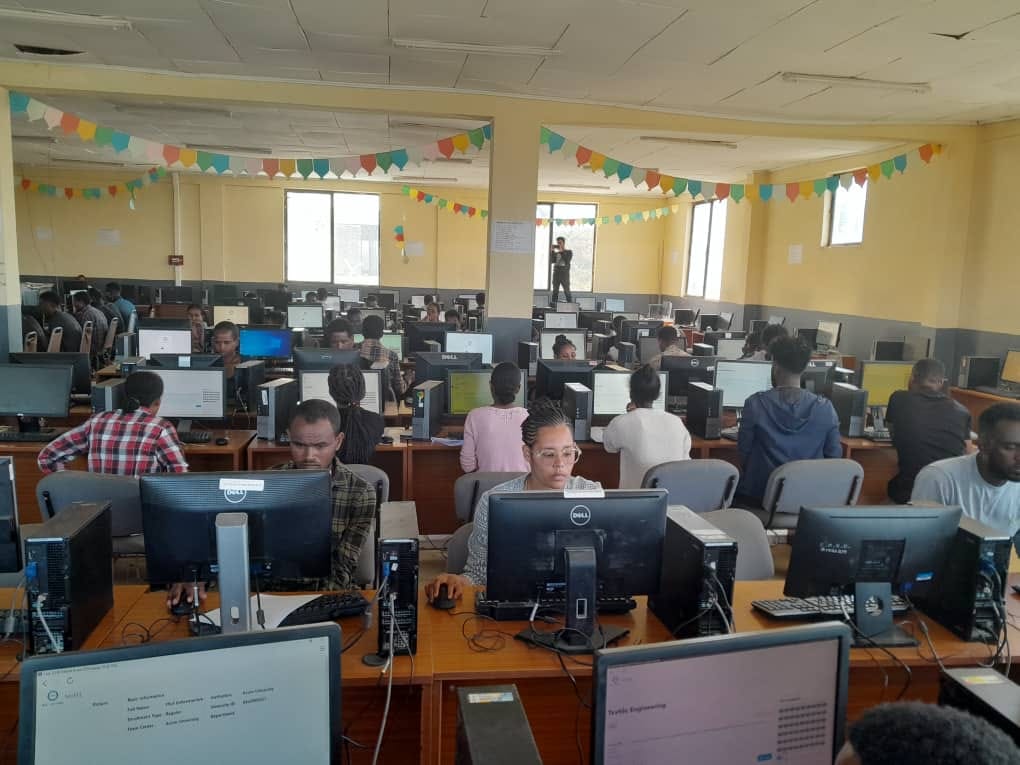

Tigray Codes offered computer coding training for secondary and preparatory students for two weeks in collaboration with Tigray Science and...

ኮምፕሪሆንሲቭ ስፔሻላይዝድ ሆስፒታል ዩኒቨርሲቲ ኣኽሱም ምስ HCP Cureblindness ብምትሕብባር ን 1000 ወገናት ነፃ ሕክምና መጥባሕቲ ስብሒ ዓይኒ ክህብ እዩ።

ኣብ ክልል ትግራይ ብዓይነታ ናይ መጀመርያ ዝኾነት 64 slices CT scan ሎሚ ዕለት Aksum University CHS & Comprehensive Specialized Hospital በፂሓ ኣላ። ኣብ ሓፂር ግዜ ናይ ተከላ ስራሕ ንምወጋን ምስ Elsmed ከምኡ ድማ ምስ ባዓል ስልጣን ምክልካል ጨረርኢትዬጽያ ናይ ስራሕ ፍቃድ ንምርካብ ኣብ ምሰራሕ ንርከብ። ሚኒሰቴር ጥዕና ኣብ ሆስፓታልና ኣብ ዝገበርዎ ዳህሳስ ክፍሊ ራድዬሎጃ ካብ […]

AKU in collaboration with German Archeological Institute holds international workshop on Perception and interpretation of Pre-Axumite Archaeology. The international workshop targets to connect the efforts of local and international scholars in a way that better contributes to further scientific inquiry. AKU Vice President for Research and Community Service Merhawi Abraha (PhD) in his welcoming speech […]